The Hidden Gold Mine: Why 2025 Was the Year Staffing Agencies Finally Activated Their Dormant Databases

If you’re running a healthcare staffing agency and haven’t felt the ground shift beneath your feet in the last 18 months, you’re not paying attention.

The data from SIA’s North American Staffing Executive Outlook doesn’t just show evolution. It shows revolution. Healthcare staffing firms are outpacing every other sector in technology adoption, platform integration, and private equity engagement, transforming how clinicians are matched, deployed, and managed.

This isn’t theoretical. It’s happening right now, and the gap between leaders and laggards is widening with every quarter. Here’s what the numbers reveal about where healthcare staffing is headed, why it’s moving faster than any other vertical, and what it means for your competitive position in 2025 and beyond.

Healthcare Staffing Firms Are Betting Big on Technology (And the Numbers Prove Why)

Let’s start with the headline statistic: 76% of healthcare staffing firms plan to increase their investment in technology and automation within the next year. That’s not incremental improvement; that’s a sector-wide strategic shift driven by executives who recognize that operational excellence in healthcare staffing now requires technological infrastructure.

Why healthcare specifically? The answer lies in compliance complexity. Healthcare staffing operates under rigid regulatory frameworks that other sectors don’t face. Credentialing requirements, licensing verification across state lines, continuing education tracking, immunization records, the administrative burden is staggering. Manual processes can’t scale at the pace the market demands.

Technology adoption isn’t a luxury in healthcare staffing anymore. It’s survival.

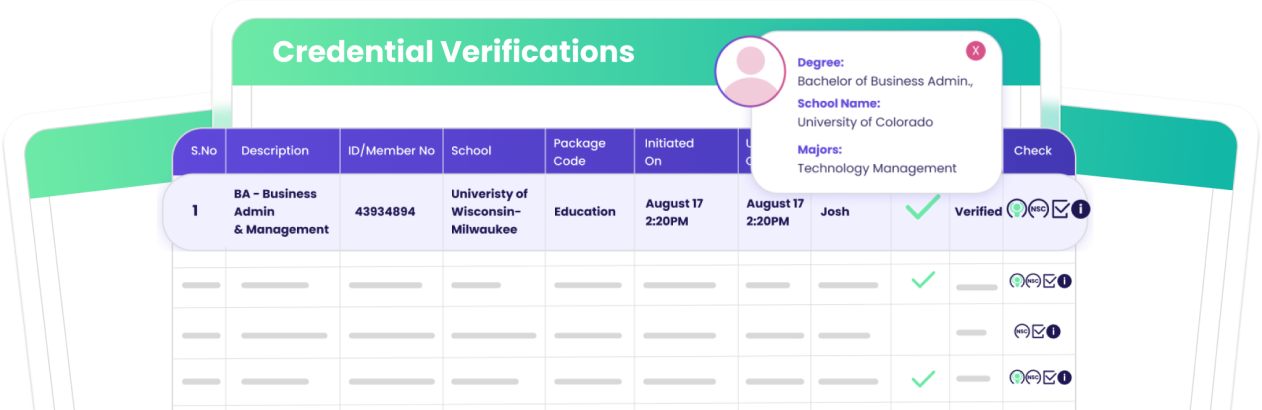

The transformation is already visible in specific applications. AI-powered credentialing is automating verification processes that used to take days or weeks. Intelligent matching systems are surfacing qualified clinicians based on specialization, location, availability, and historical performance. Workforce analytics platforms provide visibility into utilization rates, contractor satisfaction, and placement quality that wasn’t possible five years ago.

And here’s the strategic insight buried in that 76% figure: 33% of healthcare staffing executives expect AI to replace up to 40% of manual processes within three years. That’s not cautious experimentation, that’s aggressive adoption driven by clear ROI and competitive necessity.

When AI eliminates administrative friction, your recruiters stop being data entry specialists and start being relationship builders. That’s the transformation healthcare staffing leaders are pursuing, and they’re willing to invest heavily to get there.

Platform Integration: Healthcare Staffing’s Structural Advantage

The second major insight from the SIA data: 34% of healthcare staffing firms are using platforms, compared to 27% across all industries. Healthcare isn’t just adopting platforms faster, it’s uniquely suited to platform-based models.

Why? Three structural characteristics make healthcare staffing ideal for platform integration:

Structured Assignments: Healthcare roles have clear start and end dates, defined scopes of practice, and standardized requirements. This predictability makes matching, scheduling, and redeployment significantly more efficient through platform automation.

High Volume: Healthcare staffing operates at scale. Agencies are placing hundreds or thousands of clinicians across multiple facilities, shifts, and specializations simultaneously. Manual coordination breaks at this volume. Platforms thrive.

Verifiable Skills: Clinical credentials, certifications, and licenses are objectively verifiable and portable across assignments. Platform matching algorithms can leverage this structured data to make accurate recommendations at speed.

Here’s what matters for strategic positioning: platforms aren’t replacing the staffing agency model. They’re enhancing it. 41% of healthcare firms report that platforms complement their existing business models rather than disrupting them. The technology delivers operational efficiency while agencies maintain high-touch relationships with clients and clinicians.

But the trajectory is clear. While only 9% of healthcare firms operate on a platform-first model today, that number is projected to rise to 28% within five years. The agencies making this transition now are building structural advantages that will compound.

Platforms enable AI-driven workforce ecosystems that streamline compliance, accelerate onboarding, and deliver the real-time visibility that enterprise healthcare clients increasingly demand. They also align with clinician expectations, healthcare professionals want more control over their schedules, faster access to opportunities, and transparent communication. Platform-based models deliver all three.

Private Equity Sees What You Should: Healthcare Staffing’s Long-Term Growth Potential

The third pillar of the SIA data reveals where the smart money is flowing: 24% of healthcare staffing firms are majority-owned by private equity, more than twice the rate of PE ownership in other sectors.

This isn’t random. PE firms invest in businesses with defensible competitive positions, scalable operations, and predictable growth trajectories. Healthcare staffing checks every box.

The sector benefits from structural tailwinds: aging demographics driving clinical demand, regulatory complexity creating barriers to entry, and technology enablement improving unit economics. PE investors recognize these dynamics and are consolidating fragmented markets around firms with operational excellence and technological infrastructure.

And the capital deployment isn’t slowing. 29% of healthcare executives report being open to new PE investment within the next year, signaling ongoing consolidation and selective opportunities as investors navigate valuations, operational pressures, and a cautious lending environment.

Here’s what this means strategically: the healthcare staffing firms attracting investment aren’t just performing well today. They’re demonstrating scalability through technology, platform integration, and data-driven operations. They’re building businesses that can grow revenue without proportionally increasing headcount or operational complexity.

If you’re competing against PE-backed firms with modern tech stacks and platform infrastructure while running manual processes, you’re not competing on equal footing. The resource disparity compounds every quarter.

The Market Context: Stabilization After Disruption

Let’s zoom out for market perspective. According to SIA’s US Staffing Industry Forecast, the healthcare staffing market is projected at $39.4 billion in 2025 with modest 2% growth expected for 2026. This represents stabilization after the pandemic-driven volatility of 2020-2022.

Stabilization creates opportunity for firms with operational efficiency. When growth rates normalize, margin improvement becomes the primary lever for value creation. Technology adoption, platform integration, and AI-enabled automation directly impact unit economics, reducing cost per placement, accelerating time-to-fill, and improving clinician retention through better experiences.

The agencies investing in infrastructure now are positioning themselves to capture disproportionate value as the market stabilizes. They’re not just competing on recruiter relationships anymore. They’re competing on speed, efficiency, data quality, and contractor experience.

What This Means for Your Competitive Position

If you’re a healthcare staffing executive reading these statistics, you need to ask three questions:

1. Where does your firm sit on the technology adoption curve?

If you’re still managing credentialing manually, relying on spreadsheets for candidate tracking, or using email as your primary clinician communication channel, you’re operating at a structural disadvantage. The firms that have deployed AI matching, compliance automation, and multi-channel engagement platforms are filling positions faster and retaining clinicians longer.

The 76% of healthcare staffing firms increasing tech investment aren’t doing it because it’s trendy. They’re doing it because it’s working.

2. Have you evaluated platform integration for your business model?

You don’t need to abandon your agency model or eliminate your recruiting team. But if 34% of healthcare firms are using platforms and that number is projected to reach 28% on platform-first models within five years, ignoring this shift is strategic malpractice.

Platforms handle the administrative burden, matching, scheduling, compliance tracking, time management, so your recruiters can focus on relationship building, client development, and strategic placements that require human judgment.

3. Are you building a business that investors would value?

Whether or not you’re seeking PE investment, operating with an investor’s mindset forces strategic clarity. PE-backed firms are betting on scalability, defensibility, and operational leverage. Are you building systems that can grow revenue without proportionally increasing costs? Do you have data infrastructure that provides visibility into unit economics, placement quality, and contractor lifetime value?

If your answer is “we’re getting by with what we have,” you’re not competing with firms that have already made these investments.

The Healthcare Staffing Transformation Is Already Underway

Here’s the uncomfortable truth: the healthcare staffing firms winning in 2025 and beyond won’t be the ones with the biggest recruiter teams or the longest client relationships. They’ll be the ones who combined relationship excellence with technological infrastructure.

AI-powered credentialing that verifies licenses in minutes instead of days. Intelligent matching that surfaces the right clinician for the right assignment at the right time. Mobile-first contractor experiences that make accepting shifts one-tap simple. Compliance automation that eliminates manual tracking and reduces risk.

This is what 76% tech adoption, 34% platform integration, and 24% PE ownership looks like in practice. It’s healthcare staffing agencies recognizing that operational excellence now requires technological capability.

The agencies making these investments now are creating competitive moats. Every clinician placed faster, every client served more efficiently, every contractor retained longer compounds the advantage. The technology learns, the relationships deepen, and the data improves.

If you’re wondering whether this applies to your firm, the answer is yes. The SIA data doesn’t describe a future state; it describes what’s already happening across the healthcare staffing industry right now.

The question isn’t whether you need to transform your operations. The question is whether you’re moving fast enough to keep pace with competitors who’ve already started.

Schedule Your 30-Minute Demo to see how Staftr enables the healthcare staffing transformation with AI-powered matching, automated credentialing, and mobile-first contractor engagement. See our pricing options starting at $299/month for agencies ready to compete at the pace of innovation.

Because the firms rewriting the healthcare staffing playbook aren’t waiting, and neither should you.

Related Posts

AI & Technology

The $1.2 Billion Staffing…Read

The global staffing agency software market was valued at $634 million in 2025. Industry analysts project it…

The global staffing agency software market was valued at $634 million in 2025. Industry analysts project it will exceed $1.2 billion by 2032, growing at a CAGR of 10-14%.

That’s not just market growth. That’s a fundamental shift in how staffing agencies operate.

Agencies spending $634 million annually on software aren’t making frivolous purchases. They’re making strategic investments that transform operations, reduce costs, and create competitive advantages that manual processes simply cannot match.

The question isn’t whether to invest in technology. The question is whether you’ll invest strategically before your competitors build insurmountable leads.

What’s Driving $600 Million in Annual Software Investment?

Staffing agencies aren’t known for reckless spending. When an industry collectively invests over half a billion dollars annually in software, there are concrete reasons.

Reason 1: Automation Delivers Measurable ROI

The average recruiter using manual processes spends 70% of their time on administrative tasks:

- Searching databases with keyword filters: 25% of time

- Making sequential phone calls: 20% of time

- Tracking credentials manually: 10% of time

- Data entry and status updates: 15% of time

That’s 1,400 hours per year on tasks that generate zero placements.

Modern staffing platforms automate these workflows, enabling recruiters to focus on relationship-building and problem-solving:

- AI-powered matching replaces manual searching (30 minutes → 10 seconds)

- Multi-channel automated outreach replaces sequential calling (3 hours → 2 minutes)

- Automated credential tracking replaces spreadsheets (30 minutes/day → automated)

- Workflow automation replaces manual data entry (2 hours/day → automated)

The productivity gains are substantial. Recruiters using automated platforms place 40% more contractors with the same effort.

ROI Calculation for Mid-Size Agency:

- 10 recruiters currently placing 500 contractors/year

- Implementation of automation platform: $140,000/year

- Productivity increase: 40% (200 additional placements)

- Additional gross profit: $2,000,000 (200 × $10,000)

- Net benefit: $1,860,000 annually

When one software investment generates $1.86 million in incremental profit, agencies invest.

Reason 2: Compliance Costs Are Crushing Agencies

Healthcare, legal, and industrial staffing face complex compliance requirements:

- Credential verification and tracking

- HIPAA data protection standards

- OSHA safety training documentation

- State-specific licensing requirements

- Background check management

- Drug testing coordination

Manual compliance management costs agencies $25,000-$50,000 per year in dedicated staff time, plus substantial risk exposure from lapses.

Modern platforms automate compliance workflows:

- Automatic credential expiration alerts 30/60/90 days in advance

- Document management with version control and audit trails

- Automated background check and drug test coordination

- State-specific requirement templates

- Real-time compliance dashboards showing gaps

Automation reduces compliance labor by 80% while dramatically reducing risk. For agencies placing healthcare or industrial contractors, this single feature justifies the software investment.

Reason 3: Mobile-First Contractors Demand Modern Experiences

Contractors under 40 grew up with smartphones. They expect instant, mobile-first experiences.

When your platform requires contractors to:

- Log into desktop portals

- Navigate through multiple menus

- Download and complete PDF applications

- Wait days for responses

They choose agencies with better technology.

Mobile-first platforms enable contractors to:

- Receive SMS alerts for new opportunities (98% open rate within 3 minutes)

- View details and accept assignments from their phones in under 60 seconds

- Upload documents via mobile camera

- Track hours and submit timesheets in-app

- Communicate with recruiters via in-app messaging

The engagement difference is measurable: 75% response rates on mobile-first platforms vs. 3% on desktop-only systems.

Agencies invest in mobile technology because it’s the only way to compete for contractor attention.

Reason 4: External Sourcing Costs Are Unsustainable

The typical agency with a 5+ year old database has:

- 15,000-20,000 contractor contacts

- 10-15% active deployment rate (only 1,500-3,000 contractors working)

- $300,000+ annual spend on external sourcing (Indeed, LinkedIn, job boards)

That’s $300,000 spent acquiring new contractors while 85% of the existing database sits dormant.

Intelligent database activation platforms transform this equation:

- AI-powered matching identifies qualified contractors instantly from existing database

- Automated multi-channel outreach re-engages dormant contractors

- Preference tracking ensures relevant opportunity matching

- Continuous engagement maintains contractor relationships

Agencies using database activation achieve:

- 85% database utilization (up from 10-15%)

- 75% contractor response rates (vs. 3% industry average)

- 90% reduction in external sourcing costs ($270,000 annual savings)

When software reduces external sourcing from $300,000 to $30,000 annually, the ROI is immediate and undeniable.

Geographic and Vertical Market Dynamics

The staffing software market isn’t uniformly distributed. North America accounts for approximately 43% of total market share in 2025, reflecting rapid adoption of cloud-based and automated solutions.

North American Leadership

North American agencies lead adoption due to:

- Competitive labor markets where speed determines success

- High technology literacy among both recruiters and contractors

- Regulatory complexity requiring sophisticated compliance tools

- Mature SaaS ecosystem with proven vendor reliability

Agencies in competitive markets like healthcare staffing (Dallas, Phoenix, Denver) and tech staffing (San Francisco, Seattle, Austin) adopt modern platforms first. Geographic expansion follows as competitive pressure spreads.

Healthcare Staffing Drives Growth

Healthcare staffing represents the fastest-growing vertical for staffing software investment due to:

- Critical credential tracking requirements (licenses, certifications, continuing education)

- HIPAA compliance complexity

- Urgent fill requirements (hospital shifts can’t go unstaffed)

- High placement volume enabling rapid ROI

Healthcare staffing agencies report 531% increase in searches for “Medical Staffing Software”, indicating massive demand for specialized solutions.

IT and Professional Staffing Follow

IT and professional staffing agencies invest in technology to:

- Manage complex skill matching (100+ technology stacks to track)

- Coordinate remote/hybrid placements

- Track contractor availability across time zones

- Manage contract-to-hire conversion workflows

These verticals value sophisticated matching algorithms and workflow automation that handle complexity at scale.

Light Industrial Adoption Accelerates

Light industrial staffing traditionally lagged in technology adoption. That’s changing rapidly due to:

- Contractor expectations for mobile-first experiences

- Safety compliance requirements (OSHA training, equipment certifications)

- High-volume placement needs (100+ contractors per client)

- Thin margins requiring operational efficiency

Agencies that automate light industrial operations achieve cost structures competitors can’t match.

The Technology Stack Evolution

The $1.2 billion staffing software market doesn’t represent a single product category. It encompasses an evolving technology stack:

Core ATS (Applicant Tracking System)

Traditional category focused on record-keeping and basic workflow management. Dominated by legacy vendors like Bullhorn, Avionté, and Loxo.

Market trend: Mature category with slow growth as agencies migrate to modern platforms.

AI-Powered Matching and Automation

Emerging category using machine learning for instant candidate matching, automated outreach, and predictive analytics.

Market trend: Fastest-growing segment expected to represent 35% of market by 2032 as agencies prioritize automation.

Mobile Contractor Engagement

Platforms focused on mobile-first contractor experiences, in-app communication, and one-tap application workflows.

Market trend: Rapidly becoming table-stakes for contractor recruitment and retention.

Compliance and Credential Management

Specialized tools for healthcare, industrial, and legal staffing managing complex credential tracking and compliance workflows.

Market trend: Growing alongside regulatory complexity and risk aversion.

Analytics and Business Intelligence

Platforms providing real-time dashboards, predictive analytics, and performance optimization insights.

Market trend: Increasing adoption as agencies prioritize data-driven decision-making.

Modern platforms like Staftr integrate all five categories into unified solutions, replacing fragmented tech stacks with seamless end-to-end workflows.

Investment Patterns: Who’s Buying What

Not all agencies invest in technology the same way. Investment patterns reveal strategic priorities:

Small Agencies (1-10 Recruiters)

Typical investment: $10,000-$35,000/year

Priority features: Basic automation, mobile contractor access, compliance tracking

Decision driver: Operational efficiency to compete with larger agencies

Small agencies invest in technology that levels the playing field, enabling them to operate with the sophistication of much larger competitors.

Mid-Market Agencies (10-50 Recruiters)

Typical investment: $50,000-$200,000/year

Priority features: Advanced automation, database activation, multi-channel communication, analytics

Decision driver: Scaling operations without proportional headcount increases

Mid-market agencies use technology to grow revenue 40-50% without adding recruiter headcount, dramatically improving margins.

Enterprise Agencies (50+ Recruiters)

Typical investment: $200,000-$500,000+/year

Priority features: Multi-tenant architecture, enterprise integrations, advanced analytics, custom workflows

Decision driver: Managing complexity across multiple divisions, locations, and verticals

Enterprise agencies prioritize platforms that provide centralized visibility while allowing division-specific customization.

Why Agencies That Don’t Invest Fall Behind

The staffing software market isn’t growing because agencies love buying software. It’s growing because agencies that don’t invest lose competitive battles.

Speed Disadvantage

- Automated agencies fill positions in 15 minutes to 4 hours

- Manual agencies average 12+ days

- Clients choose faster agencies, even at slightly higher rates

Contractor Preference Disadvantage

- Modern platforms achieve 75% contractor response rates

- Legacy processes get 3% response rates

- Contractors work for agencies with better technology

Cost Structure Disadvantage

- Automated agencies place 40% more contractors per recruiter

- Manual agencies require proportional headcount for growth

- Technology-forward agencies achieve margins competitors can’t match

Client Retention Disadvantage

- Automated agencies provide real-time visibility and predictable fills

- Manual agencies operate opaquely with inconsistent results

- Clients move contracts to more reliable agencies

The competitive gaps compound over time. Agencies that invest in 2025 build 2-3 year leads over agencies that delay.

The Investment Decision Framework

Faced with $634 million in annual software investment across the industry, how do agencies decide what to buy?

Calculate Current State Costs

Manual Operations:

- Recruiter time on administrative tasks: $88,400 per recruiter per year

- External sourcing costs: $300,000+ per year

- Lost placements from slow fill times: $2,000,000+ per year

- Client churn from unreliable service: $2,500,000+ lifetime value

Calculate Technology State Benefits

Automated Platform:

- Recruiter productivity increase: 40% more placements

- External sourcing reduction: 90% savings

- Additional placements captured: 200-300 per year

- Improved client retention: 10-15% increase

Compare Investment to Benefit

Platform Cost:

- Mid-market agency (30 recruiters): $107,640/year

- Expected additional placements: 250/year

- Additional gross profit: $2,500,000

- Net benefit: $2,392,360

When software investment returns 22X in the first year, the decision is straightforward.

The Market Will Exceed $1.2 Billion Because Agencies Have No Choice

The staffing agency software market will reach $1.2+ billion by 2032 not because vendors are persuasive. It will grow because agencies that don’t invest will cease to exist.

Contractors demand mobile-first experiences. Clients demand fast, reliable fills. Regulations demand sophisticated compliance. Margins demand operational efficiency.

Technology isn’t optional anymore. It’s the price of admission to competitive staffing.

The only questions are:

- Will you invest strategically before competitors build insurmountable leads?

- Will you choose platforms that deliver measurable ROI, not just features?

- Will you move fast enough to capture market share instead of defending it?

Schedule Your 15-Minute Demo to see why agencies are investing in automation that delivers 75% response rates and 15-minute fill times, or explore Staftr’s complete feature set to understand what $1.2 billion in market investment is buying.

The staffing technology revolution isn’t coming. It’s here. Your competitors are investing. The question is whether you’ll lead or follow.

Frequently Asked Questions

Q: How big is the staffing agency software market?

A: The global market was $634 million in 2025 and is projected to exceed $1.2 billion by 2032, growing at 10-14% CAGR.

Q: Why are staffing agencies investing in software?

A: Automation delivers 40% productivity increases, compliance management reduces risk by 80%, mobile-first platforms achieve 75% contractor response rates, and database activation cuts external sourcing costs by 90%.

Q: What’s the ROI of staffing agency software?

A: Mid-market agencies typically see 15-25X first-year ROI through increased placements, reduced external sourcing, and improved recruiter productivity.

Q: Which staffing verticals invest most in technology?

A: Healthcare staffing leads due to compliance complexity, followed by IT/professional staffing and rapidly growing light industrial adoption.

Staffing Trends

Multi-Tenant SaaS for Staffing:…Read

Your enterprise staffing agency operates in 12 states. You have 47 recruiters across four divisions: healthcare, IT,…

Your enterprise staffing agency operates in 12 states. You have 47 recruiters across four divisions: healthcare, IT, light industrial, and legal staffing. Each division has slightly different workflows, compliance requirements, and client needs.

Your current on-premise staffing platform costs $180,000 annually in licenses, plus $75,000 for dedicated IT staff to maintain servers, manage updates, and troubleshoot issues. Every time you open a new location, provisioning new infrastructure takes 6-8 weeks and costs $30,000+.

Meanwhile, your competitors using modern multi-tenant SaaS platforms onboard new locations in 48 hours at zero incremental infrastructure cost.

This isn’t about chasing the latest buzzword. Multi-tenant SaaS architecture fundamentally changes the economics and capabilities of enterprise software, enabling scalability and innovation that legacy architectures simply cannot match.

What Multi-Tenant SaaS Actually Means

Multi-tenant architecture means multiple clients (tenants) use the same application instance while maintaining complete data isolation and security.

Think of it like an apartment building. Multiple tenants live in the same building, sharing core infrastructure (plumbing, electrical, HVAC). But each tenant has their own private space, locked door, and complete privacy from other tenants.

In single-tenant architecture:

- Each client gets their own dedicated server instance

- Infrastructure costs scale linearly with client count

- Updates must be deployed separately to each instance

- New features roll out inconsistently across clients

- Maintenance requires per-instance effort

In multi-tenant architecture:

- All clients share one highly optimized application instance

- Infrastructure costs scale logarithmically (not linearly)

- Updates deploy instantly to all clients simultaneously

- Every client gets new features immediately

- Maintenance effort is centralized and efficient

The benefits for enterprise staffing agencies are substantial: lower costs, faster innovation, easier scalability, and superior performance.

The Enterprise Staffing Agency Use Case

Enterprise staffing agencies have unique needs that multi-tenant SaaS addresses elegantly:

Geographic Expansion Without Infrastructure Headaches

Traditional scenario: Your agency wants to open a new office in Phoenix. You need to:

- Purchase server licenses for 8 new users: $24,000

- Provision hardware or cloud infrastructure: $15,000

- Configure the system for Arizona-specific compliance: 40 hours of IT time

- Train the Phoenix team: 2 weeks minimum

- Total cost and timeline: $45,000 and 6-8 weeks before first placement

Multi-tenant SaaS scenario: Your agency opens a Phoenix office. You:

- Add 8 users in the admin panel: 5 minutes

- Configure Arizona compliance rules using pre-built templates: 2 hours

- Phoenix team logs in and starts working: Same day

- Total cost and timeline: $7,192/year (8 users × $899/month) and 48 hours

The infrastructure already exists. You’re just adding users to the shared platform. Scalability is instant and economical.

Multi-Division Operations with Centralized Visibility

Enterprise agencies often run multiple specialized divisions. Healthcare staffing requires different credentials, compliance tracking, and client communication than IT staffing or light industrial.

Multi-tenant platforms enable:

- Division-specific workflows while maintaining enterprise-wide visibility

- Custom compliance rules for healthcare HIPAA, industrial OSHA, legal confidentiality

- Brand customization so each division can present unique client-facing experiences

- Unified reporting across all divisions for executive decision-making

- Shared talent pools where appropriate (nurse can also do administrative work)

Each division operates semi-independently while leveraging shared infrastructure and centralized data. You get specialization without fragmentation.

Rapid Feature Adoption Across the Enterprise

In single-tenant architectures, new features roll out slowly. The vendor must schedule updates for each client individually, coordinate downtime windows, and deal with custom configurations that break during upgrades.

In multi-tenant architectures, new features deploy to all clients simultaneously overnight. No scheduling. No downtime. No disruption.

This means your agency benefits from continuous innovation:

- New AI matching algorithms improve results for all divisions instantly

- Security patches deploy immediately across the enterprise

- UI improvements roll out uniformly for consistent user experience

- API integrations with payroll, HR, and ERP systems update automatically

You don’t wait months for “enterprise upgrade cycles.” You get improvements as soon as they’re ready.

Cost Efficiency at Scale

Multi-tenant infrastructure delivers dramatic cost advantages through resource sharing:

Single-Tenant Costs (Traditional On-Premise or Dedicated Cloud):

- Server infrastructure: $180,000/year

- IT staff for maintenance: $75,000/year

- Database licenses: $35,000/year

- Security and compliance tools: $25,000/year

- Backup and disaster recovery: $15,000/year

- Total: $330,000/year for 47 users = $7,021 per user

Multi-Tenant SaaS Costs:

- Platform subscription: $140,653/year (47 users × $2,990/month average)

- No infrastructure costs (included)

- No dedicated IT staff needed (vendor manages)

- No separate licensing (included)

- No maintenance overhead (automated)

- Total: $140,653/year for 47 users = $2,993 per user

The cost difference: $189,347 annually, or 57% savings.

These savings compound as you scale. Adding your 48th user costs $2,990/year in multi-tenant SaaS vs. potentially triggering new infrastructure investment in single-tenant architecture.

Multi-Tenant Security: Better Than Single-Tenant

Security concerns are the most common objection to multi-tenant architecture. “If everyone shares infrastructure, isn’t my data at risk?”

Actually, multi-tenant platforms typically offer superior security to single-tenant deployments.

Data Isolation Through Multiple Layers

Modern multi-tenant platforms implement strict data segregation:

Database-Level Isolation:

- Each tenant’s data lives in logically separated schemas

- Tenant ID required for every query (impossible to access wrong tenant’s data)

- Encryption keys unique to each tenant

- Separate backup schedules per tenant

Application-Level Isolation:

- Role-based access controls (RBAC) prevent unauthorized access

- Row-level security ensures queries only return tenant-specific data

- API authentication tokens scoped to individual tenants

- Audit logs track every data access by user and tenant

Infrastructure-Level Isolation:

- Network segmentation separates tenant traffic

- DDoS protection prevents one tenant from affecting others

- Resource quotas prevent any single tenant from monopolizing capacity

This defense-in-depth approach is more sophisticated than most agencies can implement on single-tenant infrastructure.

Continuous Security Updates

Single-tenant platforms require agencies to apply security patches manually. Most agencies fall behind, creating vulnerabilities.

Multi-tenant platforms apply security updates immediately to all tenants overnight. Your data is protected by enterprise-grade security without requiring internal security expertise.

Compliance Built In

Multi-tenant platforms serving healthcare, legal, and financial services clients must maintain compliance with:

- HIPAA (healthcare data protection)

- GDPR (EU privacy regulations)

- CCPA (California privacy rights)

- SOC 2 (security and availability standards)

These compliance requirements are baked into the platform architecture, not added as afterthoughts. When regulations change, the vendor updates the entire platform for all tenants simultaneously.

Your agency benefits from enterprise-grade compliance without hiring compliance officers or conducting expensive audits.

Performance Advantages of Multi-Tenant Architecture

Shared infrastructure doesn’t mean slower performance. It often means better performance.

Resource Optimization

Multi-tenant platforms use sophisticated resource management:

- Dynamic allocation: Resources shift to tenants experiencing high demand

- Load balancing: Traffic distributes across multiple servers automatically

- Caching optimization: Frequently accessed data caches intelligently

- Database query optimization: Shared queries benefit all tenants

A well-designed multi-tenant platform performs better than a poorly provisioned single-tenant deployment because resources are professionally managed at scale.

Infrastructure Quality

Multi-tenant SaaS vendors invest heavily in infrastructure because it benefits all clients:

- Enterprise-grade server hardware

- Multi-region redundancy for disaster recovery

- CDN integration for fast global performance

- Professional database administration and optimization

Most individual agencies can’t justify this level of infrastructure investment. Multi-tenant architecture makes it economical through shared costs.

Continuous Performance Monitoring

Multi-tenant vendors monitor platform performance 24/7 because downtime or slowness affects all clients simultaneously. They have strong incentives to maintain exceptional performance.

Single-tenant deployments often lack sophisticated monitoring. Issues go unnoticed until users complain.

Integration Capabilities for Enterprise Agencies

Enterprise staffing agencies need platforms that integrate with existing enterprise systems: payroll, HR, ERP, CRM, accounting.

Multi-tenant SaaS platforms excel at integration through:

Pre-Built API Integrations

Modern multi-tenant platforms offer pre-built integrations with common enterprise systems:

- Payroll systems: ADP, Paychex, Gusto

- HRIS platforms: Workday, BambooHR, SAP SuccessFactors

- Accounting software: QuickBooks, NetSuite, Xero

- Communication tools: Slack, Microsoft Teams, email platforms

These integrations are maintained by the vendor and benefit all tenants. When QuickBooks releases an API update, the vendor updates the integration once and all tenants benefit.

Custom API Development

For unique enterprise requirements, multi-tenant platforms provide robust APIs that enable custom integrations:

- RESTful APIs for data exchange

- Webhooks for real-time event notifications

- OAuth authentication for secure access

- Comprehensive API documentation and developer support

Agencies can build custom integrations that meet their specific needs while leveraging the platform’s core multi-tenant infrastructure.

Data Portability

Enterprise agencies need confidence that they can migrate data if business needs change. Multi-tenant platforms support:

- Bulk data export in standard formats (CSV, JSON, XML)

- API access to historical data

- Schema documentation for data structure understanding

- Migration assistance from vendor professional services teams

Your data isn’t trapped in proprietary formats. You maintain control and portability.

The Migration Path from Single-Tenant to Multi-Tenant

Enterprise agencies worry that migrating from single-tenant (on-premise or dedicated cloud) to multi-tenant SaaS will disrupt operations.

Modern migration follows a phased approach that minimizes risk:

Phase 1: Data Migration (Weeks 1-2)

- Export historical data from legacy system

- Import into multi-tenant platform with field mapping

- Verify data integrity and completeness

- Run parallel reports to confirm accuracy

Phase 2: Pilot Division (Weeks 3-4)

- Select one division (typically smallest or newest) for pilot

- Train pilot team on new platform

- Run pilot division on new platform while others continue legacy system

- Gather feedback and optimize workflows

Phase 3: Division Rollout (Weeks 5-8)

- Migrate divisions sequentially (one per week)

- Apply lessons learned from pilot to subsequent divisions

- Maintain legacy system access during transition

- Conduct division-specific training and support

Phase 4: Enterprise Cutover (Week 9)

- Sunset legacy system access

- Transition all remaining active data

- Conduct enterprise-wide training on advanced features

- Celebrate faster operations and reduced costs

Most enterprise agencies complete multi-tenant SaaS migration in 8-12 weeks with minimal disruption to daily operations.

Real-World Enterprise Results

A national staffing agency with 52 recruiters across 8 states migrated from single-tenant on-premise infrastructure to Staftr’s multi-tenant SaaS platform:

Before Migration:

- Infrastructure costs: $330,000/year

- New location provisioning time: 6-8 weeks

- Feature update frequency: Quarterly (with weeks of downtime)

- IT staff required: 2 full-time employees

- Database utilization: 15% (typical of agencies not using modern activation technology)

After Migration:

- Platform costs: $140,653/year

- New location provisioning time: 48 hours

- Feature update frequency: Continuous (zero downtime)

- IT staff required: 0 dedicated employees

- Database utilization: 68% (through intelligent activation features)

Annual savings: $189,347 (57% reduction)

Additional placements from faster operations: 280 per year

Additional revenue from increased placements: $2,800,000

The ROI was immediate and substantial.

Why Enterprise Agencies Choose Multi-Tenant SaaS

The decision to migrate from single-tenant to multi-tenant architecture comes down to competitive necessity:

Speed and Agility

- Open new locations in days instead of months

- Adapt workflows to market changes immediately

- Scale resources up or down without infrastructure planning

Cost Efficiency

- Eliminate infrastructure overhead and maintenance costs

- Pay only for what you use (per-user pricing)

- Redirect IT budget toward revenue-generating activities

Innovation Access

- Benefit from continuous platform improvements

- Access new AI and automation features immediately

- Stay competitive without massive technology investments

Operational Excellence

- Maintain enterprise-wide visibility across all divisions

- Enforce consistent processes while allowing division customization

- Reduce administrative overhead through automation

Legacy single-tenant architecture made sense when software licensing was sold per-server and internet connectivity was unreliable. Neither is true today.

Multi-tenant SaaS represents the modern standard for enterprise software, and staffing agencies that don’t adapt will find themselves at increasing competitive disadvantage.

The Future Is Already Here

While you’re maintaining on-premise servers and scheduling quarterly upgrade windows, your competitors are:

- Opening new locations in 48 hours instead of 8 weeks

- Deploying new AI features that improve placement rates immediately

- Scaling operations without infrastructure investments

- Reducing costs by 57% and redirecting savings to growth

Multi-tenant SaaS isn’t experimental technology. It’s the proven architecture powering the world’s fastest-growing staffing agencies.

The question isn’t whether to make the switch. The question is whether you can afford to wait while competitors build insurmountable advantages.

Schedule Your 15-Minute Demo to see how multi-tenant SaaS transforms enterprise operations, or explore Staftr’s enterprise features designed specifically for multi-state, multi-division staffing agencies.

Your infrastructure costs are optional. Your competitive disadvantage is not.

Frequently Asked Questions

Q: What is multi-tenant SaaS?

A: Multi-tenant SaaS architecture allows multiple clients to share one optimized application instance while maintaining complete data isolation, delivering lower costs and faster innovation.

Q: Is multi-tenant SaaS secure for enterprise staffing agencies?

A: Yes. Multi-tenant platforms implement database-level, application-level, and infrastructure-level isolation with enterprise-grade security that exceeds most single-tenant deployments.

Q: How much can enterprise agencies save with multi-tenant SaaS?

A: Typical savings range from 50-70% compared to single-tenant infrastructure, averaging $189,000+ annually for mid-size agencies with 40-50 users.

Q: How long does it take to migrate to multi-tenant SaaS?

A: Enterprise migrations typically complete in 8-12 weeks using phased rollout approaches that minimize operational disruption.

Staffing Agencies

Why Legacy Staffing Software…Read

Your agency has been using Bullhorn for six years. You’ve paid $84,000 in subscription fees. Your team…

Your agency has been using Bullhorn for six years. You’ve paid $84,000 in subscription fees. Your team has invested hundreds of hours customizing workflows, importing data, and training new recruiters.

And yet, your best contractor just accepted a position with a competitor who contacted her three hours before you did.

This isn’t about effort. Your recruiters work incredibly hard. This is about technology that was built for a different era, when contractors checked email daily and waited patiently by their phones for opportunities.

That era is over. Contractors now expect the same instant, mobile-first experience they get from Uber, DoorDash, and every other modern platform. Legacy staffing software can’t deliver it.

The result: you’re losing talent to faster competitors while paying premium prices for outdated technology.

The Real Cost of Legacy Staffing Platforms

Most agencies think about software costs in terms of subscription fees. That’s a mistake. The real costs are hidden in lost productivity, missed opportunities, and contractor frustration.

Time Costs: The Manual Labor Tax

Legacy platforms like Bullhorn and Loxo require extensive manual work that modern platforms automate:

Manual Database Searching:

- Legacy: 15-30 minutes per requisition searching with basic keyword filters

- Modern: 10 seconds with AI-powered matching that considers skills, availability, preferences, and performance history

- Cost per recruiter per year: 520 hours = $26,000 in recruiter time

Sequential Communication:

- Legacy: Recruiters call contractors one at a time, leaving voicemails, sending individual emails

- Modern: Automated multi-channel outreach via SMS, email, and mobile app reaches all qualified contractors instantly

- Cost per recruiter per year: 780 hours = $39,000 in recruiter time

Manual Credential Tracking:

- Legacy: Spreadsheets and calendar reminders for expiring credentials

- Modern: Automated alerts to contractors and recruiters 30/60/90 days before expiration

- Cost per recruiter per year: 156 hours = $7,800 in recruiter time

Administrative Data Entry:

- Legacy: Manual data entry for every placement, update, and status change

- Modern: Automated workflows that update records, trigger notifications, and sync data

- Cost per recruiter per year: 312 hours = $15,600 in recruiter time

One recruiter using legacy software spends 1,768 hours per year on tasks that modern platforms automate. That’s $88,400 in annual labor cost that generates zero placements.

Multiply that across a team of 10 recruiters, and legacy software is costing you $884,000 per year in wasted productivity.

Opportunity Costs: The Placements You Never Make

Speed matters in staffing. The agency that contacts contractors first wins.

Legacy platforms create delays at every step:

Slow Database Search: Your recruiter spends 25 minutes searching for ICU nurses. Meanwhile, a competitor using Staftr’s AI-powered instant matching identifies qualified candidates in 10 seconds and has already sent outreach.

By the time you contact contractors, they’ve already seen the opportunity from your competitor.

Email-Only Communication: Your platform sends email notifications to contractors. The average email response time is 8-24 hours. Your competitor sends SMS alerts with 98% open rates within 3 minutes.

Your contractors eventually see your opportunity. But they’ve already accepted positions with faster agencies.

Desktop-Only Workflows: Your contractors have to log into a clunky desktop portal to view opportunities and apply. That takes 15-20 minutes and requires them to be at a computer.

Your competitor’s contractors receive mobile push notifications, view opportunities on their phones, and accept with one tap in under 60 seconds.

The result: Your fill times average 12+ days while competitors achieve 15-minute to 4-hour fills.

How many placements are you losing to faster agencies? If you’re placing 500 contractors per year with a 12-day average fill time, you could likely place 700-800 contractors per year with modern technology. That’s 200-300 lost placements annually.

At $10,000 gross profit per placement, legacy software is costing you $2,000,000 to $3,000,000 in annual revenue.

Contractor Experience Costs: The Talent That Stops Responding

Legacy platforms create terrible contractor experiences. The consequences compound over time.

Common Contractor Complaints About Legacy Systems:

According to Reddit discussions from recruiters using Bullhorn:

- “Extremely slow system performance”

- “Outdated, clunky user interface reminiscent of 1990s software”

- “Poor calendar integration”

- “Confusing contracts and auto-renewal policies”

- “Unhelpful and slow customer service with days-long wait times”

And according to Loxo users on G2:

- “Fragile integrations with critical webhooks that often fail”

- “Slow, generic, and unhelpful support responses”

- “Platform bugs and inconsistent feature reliability”

- “Steep learning curve requiring weeks of setup and training”

When contractors have to deal with:

- Logging into portals that crash or load slowly

- Navigating confusing menus to find opportunities

- Downloading PDFs instead of viewing mobile-optimized content

- Filling out redundant forms every time they apply

- Waiting days for responses to simple questions

They start ignoring your outreach. Your database response rate drops from 75% (what modern platforms achieve) to 3% (the industry average with legacy systems).

You’re not losing contractors because they don’t want to work. You’re losing them because your technology makes working with you painful.

Client Satisfaction Costs: The Contracts You Lose

Your clients don’t care what ATS platform you use. They care about results.

When your legacy platform causes:

- 12-day fill times while competitors deliver in hours

- Missed urgent requests because your system can’t mobilize contractors quickly

- Inconsistent quality because you’re rushing to fill positions with whoever responds first

- Poor communication because your platform doesn’t provide real-time visibility

Your clients move to faster, more reliable agencies.

Client acquisition costs $15,000-$25,000 in sales and marketing effort. Client retention generates contracts worth $500,000 to $1,000,000+ over 3+ years.

If legacy software causes you to lose even 10% of clients to competitor churn, that’s $2,000,000 to $4,000,000 in lifetime value walking out the door.

Why Legacy Platforms Can’t Compete

It’s not just about adding features. Legacy platforms are built on architectural foundations that prevent them from delivering modern experiences.

Built for Desktop, Not Mobile

Legacy platforms were designed when recruiters and contractors worked from office computers. Their mobile apps are afterthoughts—often just responsive web views that load slowly and function poorly on small screens.

Modern platforms like Staftr are mobile-first by design. Contractors can view opportunities, upload documents, accept assignments, track hours, and communicate with recruiters entirely from their phones.

The difference in contractor engagement is measurable: 75% response rates on mobile-first platforms vs. 3% on desktop-centric legacy systems.

Built for Record-Keeping, Not Activation

Legacy ATS platforms excel at storing data. They’re digital filing cabinets. But they don’t activate that data.

Modern platforms treat your database as a living, engaged talent pool. They use AI-powered matching to identify opportunities for contractors proactively, send automated engagement messages between assignments, track contractor preferences and career goals, and maintain relationships at scale.

Your database isn’t just a list of names. It’s a revenue-generating asset when you have the right technology.

Built for Manual Processes, Not Automation

Legacy platforms require human intervention at every step: searching databases, contacting contractors, tracking responses, verifying credentials, updating statuses, sending client notifications.

Modern platforms automate these workflows end-to-end. When a client submits a requisition, the platform instantly matches contractors, sends multi-channel outreach, tracks responses, verifies credentials, and notifies clients—all without recruiter intervention.

This isn’t about replacing recruiters. It’s about freeing them from administrative busy work so they can focus on relationship-building and strategic problem-solving.

Built for Email, Not Multi-Channel Communication

Legacy platforms assume email is the primary communication channel. But contractors aren’t checking email constantly.

Modern platforms use multi-channel orchestration:

- SMS for urgent time-sensitive opportunities (98% open rate within 3 minutes)

- Email for detailed information and documentation (good for non-urgent communication)

- Mobile app push notifications for real-time updates (50-60% open rate)

- In-app messaging for two-way communication with recruiters

The platform automatically learns which channels each contractor prefers and optimizes outreach accordingly. Response times drop from hours to an average of 2.5 minutes.

The Migration Math: When Does Switching Make Sense?

Switching platforms feels risky. You’ve invested years in your current system. Your data is there. Your team knows the workflows.

But staying with legacy software has costs too. Here’s how to calculate whether migration makes financial sense:

Annual Cost of Legacy Platform:

- Software subscription: $50,000 (10 users at $5,000/year)

- Wasted recruiter time: $884,000 (10 recruiters × $88,400 in automated tasks)

- Lost placements (200 at $10K gross profit): $2,000,000

- Client churn (10% lifetime value): $2,500,000

- Total Annual Cost: $5,434,000

Annual Cost of Modern Platform:

- Software subscription: $35,880 (Staftr PRO tier at $2,990/month)

- Efficiency gains (not costs): Recruiters place 40% more contractors

- Increased placements: +$2,000,000 revenue

- Improved retention: +$2,500,000 lifetime value

- Total Annual Impact: +$4,464,120

Even accounting for migration effort (typically 30-60 days), the ROI is immediate and substantial.

What Modern Staffing Platforms Do Differently

Modern platforms aren’t just “better versions” of legacy ATS systems. They’re fundamentally different architectures designed for the modern staffing environment.

Multi-Tenant SaaS Architecture

Instead of expensive on-premise installations or single-tenant cloud deployments, modern platforms use multi-tenant SaaS architecture that delivers:

- Lower operational costs through shared infrastructure

- Continuous updates deployed to all clients simultaneously

- Rapid scalability without provisioning new servers

- Enhanced security with enterprise-grade data isolation

- API integrations with HR, payroll, ERP, and messaging systems

This architecture enables features that legacy platforms simply can’t match without complete rebuilds.

AI-Powered Intelligence Throughout

Modern platforms use machine learning to:

- Match contractors to opportunities based on dozens of factors beyond keywords

- Predict which contractors are most likely to accept based on historical patterns

- Optimize communication timing and channel selection for each contractor

- Identify contractors at risk of churn and trigger re-engagement workflows

- Provide predictive analytics on fill times and placement success rates

This intelligence gets smarter over time as the system learns from your agency’s specific patterns.

Contractor-Centric Design

Legacy platforms are built for recruiters. Modern platforms are built for contractors.

When contractors love using your platform, they respond faster, accept more opportunities, and refer their friends. Contractor engagement drives placement volume, which drives revenue.

Real-Time Everything

Modern platforms provide real-time visibility to all stakeholders:

- Contractors see opportunity status updates as they happen

- Clients track candidate activity and fill progress live

- Recruiters get instant notifications when contractors respond

- Management views placement metrics and capacity dashboards updated continuously

No more “let me check and get back to you” delays.

The Migration Path: Less Painful Than You Think

Switching platforms doesn’t require months of downtime or complete operational disruption. Modern implementation follows a phased approach:

Week 1-2: Data Migration

- Export contractor, client, and placement data from legacy system

- Import into new platform with automated field mapping

- Verify data integrity and completeness

- No disruption to daily operations

Week 3-4: Team Training

- Role-based training for recruiters, admins, and managers

- Hands-on practice with test data

- Workflow customization to match your processes

- Create quick reference guides and documentation

Week 5-6: Parallel Operation

- Run new platform alongside legacy system

- Start new placements in new system

- Continue managing existing placements in legacy system

- Compare metrics and identify optimization opportunities

Week 7-8: Full Transition

- Migrate remaining active placements

- Sunset legacy platform access

- Optimize workflows based on early results

- Celebrate faster fill times and happier contractors

Most agencies are fully operational on modern platforms within 60 days, with measurable improvements appearing within the first 30 days.

The Competitive Reality

While you’re debating whether to migrate from legacy software, your competitors are already using modern platforms to:

- Contact contractors in seconds while you’re still searching your database

- Achieve 75% response rates while you’re stuck at 3%

- Fill positions in 15 minutes while you’re averaging 12 days

- Place 40% more contractors with the same recruiter headcount

- Win client contracts by demonstrating superior speed and reliability

Every month you stay on legacy software, competitors capture market share that should be yours.

The question isn’t whether to migrate. The question is whether you can afford to wait.

Stop Paying Premium Prices for Mediocre Results

Legacy staffing platforms charge premium prices for technology built 15-20 years ago. They’re slow to innovate because they’re constrained by outdated architectures and massive technical debt.

Meanwhile, modern platforms deliver:

- AI-powered matching in seconds instead of manual searching in minutes

- Multi-channel automated outreach instead of one-at-a-time phone calls

- Mobile-first contractor experiences instead of desktop-only portals

- Real-time visibility instead of static reports

- Continuous innovation instead of annual “upgrades” that break your workflows

You don’t have to settle for software that makes your job harder.

Schedule Your 15-Minute Demo to see how modern platforms transform daily operations, or explore Staftr’s complete feature set to understand what you’re missing with legacy technology.

Your contractors are waiting. Your clients are waiting. The only question is whether they’ll be waiting for you or your faster competitors.

Frequently Asked Questions

Q: What are the main problems with Bullhorn and other legacy ATS platforms?

A: Slow performance, poor automation, email-only communication, desktop-centric design, manual workflows, and inflexible integrations that reduce recruiter productivity and contractor engagement.

Q: How much does legacy staffing software actually cost?

A: Beyond subscription fees, legacy platforms cost $88,400 per recruiter annually in wasted time on manual tasks, plus $2-3M in lost placements from slow fill times.

Q: Is it hard to switch from legacy ATS to modern platforms?

A: Most agencies complete full migrations in 60 days with phased implementation that minimizes disruption and allows parallel operation during transition.

Q: What makes modern staffing platforms different from legacy ATS?

A: AI-powered automation, multi-tenant SaaS architecture, mobile-first design, multi-channel communication, real-time visibility, and contractor-centric experiences.

Staffing

From 12 Days to…Read

It’s Monday at 9 AM. A hospital calls your healthcare staffing agency with an urgent need: they…

It’s Monday at 9 AM. A hospital calls your healthcare staffing agency with an urgent need: they need an ICU nurse for a night shift starting Wednesday.

In a traditional staffing model, here’s what happens next:

Your recruiter searches the database for qualified ICU nurses. They find 34 potential matches. Now they start making calls. Five nurses don’t answer. Twelve answer but aren’t available. Eight are interested but need more details. They email information packets. Wait for responses. Follow up via phone. By Tuesday afternoon, they’ve secured one commitment. The hospital gets their nurse Wednesday night.

Total time to fill: 2.5 days. That’s actually faster than the industry average of 12+ days.

Now here’s what happens with intelligent staffing automation:

The hospital submits the request through your platform at 9 AM Monday. AI-powered matching instantly identifies 12 qualified ICU nurses based on credentials, location, availability, shift preferences, and past performance. Automated multi-channel outreach goes out via SMS, email, and mobile app within seconds. By 9:15 AM, seven nurses have viewed the opportunity on their phones. By 9:22 AM, three have clicked “interested.” By 9:27 AM, one has accepted.

Total time to fill: 27 minutes.

This isn’t science fiction. This is the reality for staffing agencies using modern technology.

The True Cost of Slow Staffing

Before we talk about solutions, let’s quantify the problem.

Client Impact:

- Unfilled shifts cost hospitals $300-$500 per hour in overtime and productivity loss

- A 12-day fill time on a critical position costs clients $36,000-$60,000

- Slow agencies lose contracts to faster competitors

- Emergency requests become routine because clients don’t trust normal timelines

Contractor Impact:

- Good contractors book their next gig weeks in advance

- By the time slow agencies contact them, they’re already committed elsewhere

- Contractors tell friends which agencies respond fast and which don’t

- Your talent pool shrinks because contractors stop checking your outreach

Agency Impact:

- Recruiters spend 70% of their time on manual outreach and follow-up

- Slow fill times reduce placement volume, capping revenue growth

- Client churn increases as frustrated clients move to faster competitors

- Cost per placement rises as recruiters spin their wheels on hard-to-fill positions

One medium-sized staffing agency calculated that reducing average fill time from 12 days to 1 day would allow them to place 40% more contractors with the same recruiter headcount. That’s a $2.4M annual revenue increase with zero additional labor cost.

Speed isn’t just convenient. Speed is profitable.

Why Traditional Staffing Is Slow

The problem isn’t effort. Recruiters work incredibly hard. The problem is process.

Manual Database Searching

Traditional ATS platforms require recruiters to manually search databases using keyword filters. This takes 15-30 minutes per requisition.

The results are hit-or-miss. Maybe they find the perfect candidate on the first search. Maybe the perfect candidate’s profile lists “intensive care” instead of “ICU” and doesn’t show up. Maybe the recruiter doesn’t think to search for related specialties.

Every search is a fresh start. The platform doesn’t learn. It doesn’t suggest related skills. It doesn’t rank candidates by likely acceptance rate.

Sequential Communication

Once recruiters identify candidates, they contact them one at a time:

- Call Maria: no answer, leave voicemail

- Call Jennifer: interested, send details via email

- Wait for Jennifer’s response

- Call David: already took another position

- Call Nicole: wants to think about it

This sequential process means 3-5 hours to contact 20 candidates. By the time you reach candidate #15, candidates #1-5 have already moved on.

Email-Based Workflows

Most agencies still rely on email as their primary communication channel with contractors. But contractors aren’t sitting at computers refreshing their inbox.

The average email response time for contractors is 8-24 hours. That’s too slow when opportunities fill in minutes.

Desktop-Only Systems

Legacy platforms were built for desktop computers. Contractors have to log into a portal, navigate through menus, find opportunities, download PDFs, fill out applications, and submit.

That might take 20 minutes if contractors are highly motivated. Most contractors bail after step 2.

Mobile-first platforms let contractors view opportunities, review details, and accept assignments in under 60 seconds from their phone. The friction difference is massive.

How Modern Platforms Achieve 15-Minute Fill Times

The staffing speed revolution isn’t about working harder. It’s about removing friction through intelligent automation.

AI-Powered Instant Matching

Modern platforms use machine learning to analyze hundreds of data points and identify the best contractor matches in seconds:

Credential Matching:

- Required certifications and licenses

- Specialty training and experience

- Credential expiration dates

- Continuing education status

Availability Matching:

- Current assignment status

- Historical availability patterns

- Stated schedule preferences

- Geographic location and commute limits

Performance Matching:

- Past client ratings and feedback

- Assignment completion rates

- No-show history

- Response time patterns

Preference Matching:

- Preferred shift types (days, nights, weekends)

- Desired assignment length

- Client type preferences

- Career development goals

The AI doesn’t just find qualified contractors. It finds contractors who are qualified, available, and likely to accept.

This turns a 30-minute manual search into a 10-second automated process.

Multi-Channel Automated Outreach

The moment opportunities are posted, qualified contractors receive notifications through their preferred channels:

SMS Alerts:

- Immediate delivery for time-sensitive opportunities

- 98% open rate within 3 minutes

- One-click link to view full details

- Best for urgent same-day or next-day needs

Email Notifications:

- Detailed opportunity information

- Allows contractor to review and compare multiple options

- Good for assignments starting 3+ days out

- Works well for contractors who prefer thorough research

Mobile App Push Notifications:

- Real-time alerts for new opportunities

- Contractors can review, compare, and accept in-app

- Push notifications have 50-60% open rates

- Ideal for contractors actively looking for work

In-App Opportunity Feed:

- Browse all available opportunities

- Filter by location, specialty, shift type

- Save favorites for later review

- Apply with one-tap

Contractors receive the same opportunity through multiple channels simultaneously. They respond through whichever channel they happen to check first.

Response time drops from hours to minutes.

One-Tap Application and Acceptance

Traditional staffing platforms make contractors jump through hoops:

- Log into portal (username and password hunt)

- Navigate to opportunities section

- Click on specific opportunity

- Download PDF with details

- Fill out application form

- Upload recent documents

- Submit and wait for confirmation

Modern platforms eliminate 90% of this friction:

- Receive SMS or push notification

- Tap link to view opportunity

- Review details and requirements

- Tap “I’m interested” or “Accept”

- Done

The difference between a 10-step process and a 2-step process is the difference between 3% response rates and 75% response rates.

Real-Time Visibility and Communication

Both clients and contractors see status updates in real-time:

For Clients:

- Number of contractors notified

- Number who viewed the opportunity

- Number who expressed interest

- Estimated time to fill

For Contractors:

- Confirmation of application received

- Position status (open, filled, pending)

- Next steps and timeline

- Direct messaging with recruiter

This transparency builds trust and reduces anxious phone calls on both sides.

Automated Workflow Orchestration

Smart platforms automatically handle administrative tasks that used to require recruiter time:

- Credential verification checks trigger automatically when contractors express interest

- Document collection requests send automatically if required documents are missing

- Client notifications go out automatically when contractors accept

- Onboarding workflows start automatically upon acceptance

- Time tracking and invoicing begin automatically when assignments start

Recruiters focus on relationship-building and problem-solving instead of administrative busy work.

The Metrics That Matter

Agencies using intelligent automation achieve measurably different results:

Traditional Staffing:

- Average time to fill: 12+ days

- Contractor response rate: 3%

- Acceptance rate: [NEEDS SOURCE – industry average not available]

- Fill rate for urgent requests: 40-50%

- Recruiter capacity: 50-60 placements per recruiter per year

Modern Platform Staffing:

- Average time to fill: 15 minutes to 4 hours

- Contractor response rate: 75%

- Acceptance rate: 47%

- Fill rate for urgent requests: 90%+

- Recruiter capacity: 120-150 placements per recruiter per year

The productivity gains compound. Faster fills mean happier clients. Happier clients mean more requisitions. More requisitions mean more placements. More placements mean more revenue per recruiter.

One recruiter using a modern platform can accomplish the work of 2-3 recruiters using traditional methods.

Implementation: From 12 Days to Minutes

You don’t need to replace your entire tech stack overnight. Start with high-impact improvements:

Phase 1: Automate Matching (Week 1-2) Replace manual database searches with AI-powered matching. This alone cuts research time from 30 minutes to 10 seconds per requisition.

Phase 2: Enable Multi-Channel Outreach (Week 3-4) Add SMS and mobile app capabilities to your communication mix. Measure response rate differences between email, SMS, and push notifications.

Phase 3: Simplify Contractor Actions (Week 5-6) Reduce application friction. Enable one-click interest expression and acceptance. Remove unnecessary form fields and document requests.

Phase 4: Automate Workflows (Week 7-8) Identify repetitive admin tasks and automate them: credential checks, document collection, client notifications, onboarding triggers.

Phase 5: Measure and Optimize (Ongoing) Track time to fill by specialty, location, shift type, and urgency level. Identify bottlenecks and systematically remove them.

Most agencies see measurable improvements within 30 days and dramatic changes within 90 days.

The Competitive Advantage of Speed

In staffing, speed compounds.

Fast agencies get first pick of contractors. Contractors respond to the first agency that contacts them with a good opportunity, not the third or fourth.

Fast agencies build reputations with clients for reliability. When a client has an urgent need, they call the agency they trust to deliver quickly.

Fast agencies place more contractors per recruiter, generating higher revenue without proportional cost increases.

Fast agencies attract better contractors because contractors prefer working with agencies that respect their time and communicate efficiently.

Speed creates a flywheel effect. The faster you get, the more competitive advantages accumulate.

The Technology That Enables Speed

Modern staffing platforms like Staftr are purpose-built for speed:

- AI-powered matching identifies ideal candidates in seconds, not hours

- Multi-channel automated outreach via SMS, email, and mobile app reaches contractors instantly

- Mobile-first contractor experience enables one-tap application and acceptance

- Real-time visibility shows clients and contractors exactly what’s happening

- Automated workflows handle admin tasks without recruiter intervention

Agencies using these platforms achieve average response times of 2.5 minutes and fill times of 15 minutes to 4 hours, compared to industry averages of multiple hours and 12+ days.

The technology exists. The question is whether your competitors implement it before you do.

Stop Losing Races You Should Win

You have the contractors. You have the client relationships. You have the expertise.

What you don’t have is the speed to compete in a market where contractors book their next gig weeks in advance and clients expect same-day fills for urgent requests.

Every day you operate with 12-day fill times, faster competitors are capturing market share you should own.

The staffing speed revolution isn’t coming. It’s here.

Schedule Your 15-Minute Demo to see how intelligent automation transforms time to fill, or explore Staftr’s speed optimization features to learn more about competing on speed.

Frequently Asked Questions

Q: What is a good time to fill in staffing?

A: Traditional staffing agencies average 12+ days. Modern platforms achieve 15-minute to 4-hour fill times through AI matching and automated workflows.

Q: How can staffing agencies reduce time to fill?

A: Implement AI-powered matching, multi-channel automated outreach, mobile-first contractor experiences, and workflow automation to eliminate manual bottlenecks.

Q: Why is time to fill important in staffing?

A: Faster fills increase placement volume, improve client satisfaction, capture contractors before competitors, and boost revenue per recruiter.

Q: What causes slow time to fill?

A: Manual database searching, sequential one-at-a-time communication, email-only outreach, and desktop-only systems create unnecessary friction and delays.

Contractor Marketplaces

The Contractor Redeployment Crisis:…Read

Your healthcare staffing agency just successfully placed Emily, an experienced ICU nurse, on a 13-week assignment at…

Your healthcare staffing agency just successfully placed Emily, an experienced ICU nurse, on a 13-week assignment at a major hospital. She performed brilliantly. The client loved her. Emily told your recruiter she’d “definitely work with you guys again.”

The assignment ends on Friday. By Monday morning, Emily has accepted a position with your competitor.

This scenario plays out thousands of times every day across the staffing industry. Agencies invest heavily in sourcing, screening, and placing contractors, only to watch them disappear the moment an assignment concludes.

The industry redeployment rate is 3%. That means 97% of your successfully placed contractors never work for you again.

The Hidden Economics of Failed Redeployment

Let’s break down what redeployment failure actually costs.

Acquisition Cost Per Contractor:

- Sourcing (job boards, ads, referrals): $500

- Screening and interviews: $300

- Credential verification: $200

- Onboarding and training: $400

- Total: $1,400 per contractor

Revenue Per Contractor:

- Average first assignment: $10,000 in gross profit

- Average second assignment: $10,000 in gross profit

- Average third assignment: $10,000 in gross profit

An agency that redeploys contractors 2-3 times amortizes acquisition costs across $30,000+ in revenue. An agency that loses contractors after one placement spends $1,400 to generate $10,000, then starts from scratch.

The difference compounds fast:

Scenario A: 3% Redeployment Rate (Industry Average)

- 1,000 placements per year

- 970 contractors work once and disappear

- 30 contractors work multiple times

- Total acquisition cost: $1,358,000

- Acquisition cost per placement: $1,358

Scenario B: 47% Redeployment Rate (Modern Platform)

- 1,000 placements per year

- 530 contractors work once

- 470 contractors work 2-3 times

- Total acquisition cost: $742,000

- Acquisition cost per placement: $742

- Annual savings: $616,000

That’s not counting the soft costs: recruiter time, client satisfaction from consistent quality, reduced onboarding friction, and competitive advantage from faster fills.

Redeployment isn’t a nice-to-have. It’s the difference between profitability and survival.

Why Redeployment Fails in Traditional Systems

Agencies don’t fail at redeployment because they don’t care. They fail because their systems make redeployment nearly impossible.

The Black Hole Problem